Holiday Spending Through the Decades: The Surprises Hidden in Our Holiday Splurges

The Holiday Analysis Adventure

The Holiday Analysis Adventure

It’s that time of year again — the holiday jingles are taking over every store, lights are going up, and we’re getting ready to analyze some of the most interesting spending habits of the holiday season. But this isn't your ordinary deep dive into consumer behavior. We’re here to look at how much we love holiday spending, using HyperArc, our AI-powered BI tool, to analyze U.S. Census data since 1991 to bring you the juiciest insights. This post is brought to you by HyperArc, where AI meets analytics to keep holiday spending data jolly.

And hey, if you’re a wordsmith wanting to help us tell more of these data stories, send us a note at blog@hyperarc.com. We’re always looking for writing partners!

The Big Picture—Decades of Holiday Spending

Before diving into specifics, let’s look at the overall trends. Between 1991 and 2023, spending during November and December has seen a consistent upward trend — because who can resist a good holiday deal, right? In total, we’re talking trillions of dollars across ten product categories. Leading the way in this retail extravaganza is GAFO (General Merchandise, Apparel, Furniture, and Other), with a jaw-dropping $5.67 trillion spent since 1992. Automobile dealerships also brought the vroom-vroom spirit to the holiday season, clocking in at a not-so-modest $4.51 trillion in sales. And we can't ignore the steady march of grocery store spending, which took its $2.84 trillion share, fueled by our collective need for pumpkin pie and holiday roast.

Women’s Clothing Stores - Stitching Together the Story

Let’s talk about holiday fashion. Women’s clothing stores have seen their fair share of twists and turns in the holidays from 1992 to 2023. When the financial crisis hit in 2008, spending dropped from $6.69 billion to $5.97 billion. Shoppers were feeling the pinch, and new holiday dresses were just not the priority. However, after a bit of a post-crisis bounce, the pandemic in 2020 hit the fashion world once again, dragging spending down to $5.34 billion.

Interestingly, the recovery after COVID was not as robust as expected. In 2021, there was a bit of a rebound to $6.6 billion, but spending never quite regained its pre-pandemic heights. It seems that comfort-wear, loungewear, and maybe even just a shift in priorities have taken their toll on holiday clothing shopping habits. Plus, let's face it, Zoom calls don’t demand sparkly new dresses the way office parties used to.

Automobiles & Dealerships - Pumping the Brakes

Who knew that holiday spending wasn't just about gifts under the tree but also new wheels in the driveway? Automobile dealers have had a wild ride between 1992 and 2023. The financial crisis of 2008 sent auto spending plummeting from $136.8 billion in 2007 to just $96.3 billion in 2008. People hit the brakes on big purchases, and cars were no exception.

Fast forward to the pandemic, and it’s a different story. While 2020 did see some uncertainty, with spending at $204 billion, the recovery was impressive, climbing to $226 billion by 2021 and further to $244 billion by 2023. If anything, COVID seemed to trigger a sense of “treat yourself”—or perhaps “get away from it all”—attitude, and consumers found joy in purchasing new cars. It would be interesting to further analyze what “type” of cars were purchased. We can’t be alone in having friends who purchased a camper during COVID!

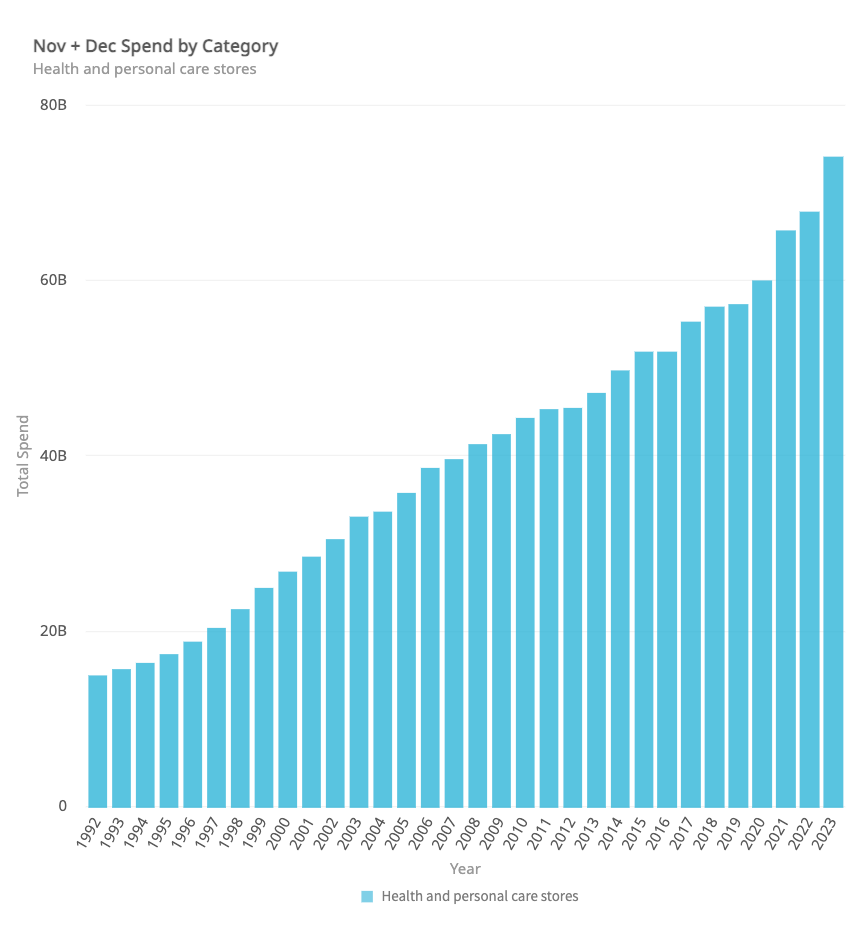

Health and Personal Care Stores – The Rise and Resilience of Self-Care

Now, let’s shift gears and look at health and personal care spending. This category showed remarkable resilience during both the financial crisis and COVID. The biggest spike in spending came between 2020 and 2021, when personal care spending jumped from $60.1 billion to $65.7 billion—the largest increase in the dataset.

Clearly, if the pandemic taught us anything, it was the importance of taking care of ourselves. Hand sanitizers, vitamins, skincare routines, or even a new set of weights for the living room — it all counted towards self-care, and it was all worth the holiday splurge. And this trend seems to be here to stay, with 2023 spending reaching an all-time high of $74.3 billion.

Wrapping Up the Holiday Spending Journey

So, what did we learn from this wild ride through the last three decades of holiday spending? While consumer spending generally trends upwards, it’s not immune to the broader economic landscape. Women’s clothing took hits during the financial crisis and COVID, while automobile sales showed impressive resilience and recovery post-pandemic. And, perhaps most heartening of all, health and personal care spending saw its largest surge during the pandemic — a reflection of our collective commitment to taking better care of ourselves.

As we head into another holiday season, it’s fascinating to see how our spending tells the story of where we are, what we care about, and how we adapt. Whether it’s gifts, a new car, or simply a renewed focus on well-being, holiday spending is more than just dollars and cents — it’s a reflection of who we are.

Bonus Section:

Ok, enough talk about the unpredictable events. What about trends for an election year? While the post didn’t focus on election year, it generated 1000x the context of your traditional BI tool. Just by using HyperArc, we enable you to retroactively ask the following question: How has election year impacted spending for women's clothing, dealership, and self-care products?

Our AI agent analyzes your historical analysis and produces a citeable explanation of where and how it led to the analysis. Reach out if you’re interested in learning more! https://www.hyperarc.com/contact-us

Data Source for the analysis: https://www.census.gov/retail/sales.html